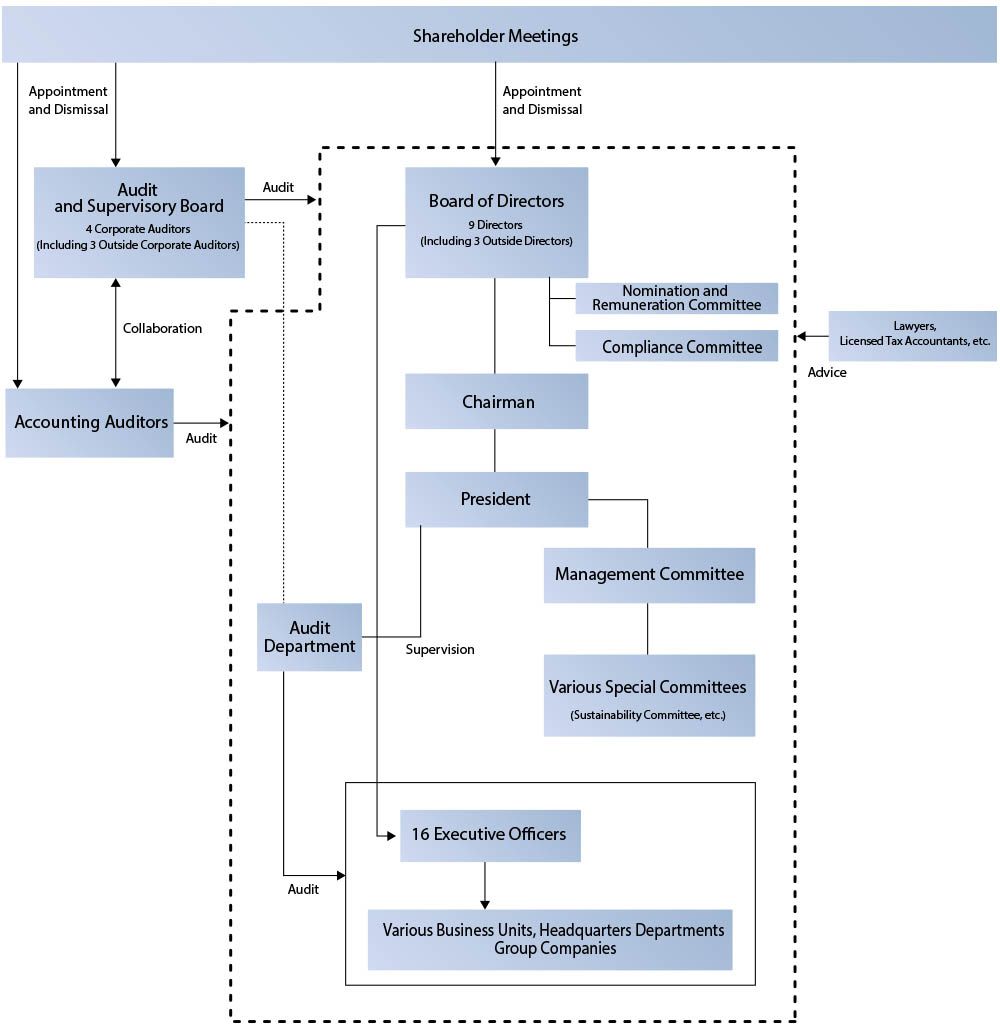

Corporate Governance

Basic Principles

We are committed to establishing transparent and fair corporate governance, achieving prompt and decisive decision-making, promoting enduring growth, and strengthening our financial health.

In the process of achieving our management objectives, we also aim to increase our corporate value by improving our compliance, risk management, management oversight, and other internal control systems with the understanding and support of our stakeholders, while also giving thought to bettering our relationships with these stakeholders.

Corporate Governance Structure

In line with Japan's Corporate Governance Code, we are a Company with Kansayaku (Audit and Supervisory) Board.

Our system also includes the role of executive officer (shikkoyaku), separating executive decision-making and supervisory functions from business execution-related functions and thereby strengthening our capacity in both of these areas.

We have appointed three independent Outside Directors to the Board of Directors to enhance our supervisory capabilities.

Management Structure

| Name | Positions and responsibilities within the Company | Independent |

|---|---|---|

| Shozo Buto | Chairman. General supervisor of the Research & Development Center | |

| Shinichi Hirano | President | |

| Minoru Yamakuni | Director & Senior Managing Executive Officer General Manager of Electronics & Precision Products Division | |

| Katsuyuki Sakamoto | Director & Senior Officer Responsible for the Headquarters Division, in charge of the Auditing Department, General Affairs and Human Resources Department, Legal Department, company-wide

compliance, and company-wide risk management |

|

| Hiroharu Senju | Director & Senior Officer. General Manager of the Electrical Products & Systems Division. In charge of Social Infrastructure System business, responsible for Sales companies, branches, and sales offices | |

| Takaichi Hatano | Director & Senior Officer. General Manager of Clean Transport System Division | |

| Tatsunobu Sako | Outside Director | ✓ |

| Jun Fujioka | Outside Director | ✓ |

| Akiko Fujioka | Outside Director | ✓ |

| Satoru Hori | Corporate Auditor | |

| Kenji Ohnishi | Outside Corporate Auditor | ✓ |

| Koichi Yuikawa | Corporate Auditor | |

| Kayo Tamura | Outside Corporate Auditor | ✓ |

Nomination and Remuneration Committee

The Nomination and Remuneration Committee evaluates the selection, dismissal, and remuneration system of directors and other officers. This committee is composed of the Chairman, the President, two independent outside directors, and one independent outside corporate auditor. The committee advises and makes recommendations to the Board of Directors, which then makes resolutions. The roles and members of the Nomination and Remuneration Committee are as follows.

| Name | Role | Members |

|---|---|---|

| Nomination and Remuneration Committee | Deliberation on issues related to the selection, dismissal, and remuneration of directors and other officers and provision of advice and recommendations to the Board of Directors | Chairman: Shozo Buto President (Committee Chairman): Shinichi Hirano Outside Director: Koichi Yuikawa Outside Director: Jun Fujioka Outside Corporate Auditor: Kenji Onishi |

Director Compensation System

Policy for Determining Executive and Other Compensation.

Our company’s executive compensation system consists of fixed compensation; performance-linked compensation that reflects the performance, position, and contribution of each director; and performance-linked stock compensation.

The Nomination and Remuneration Committee, established in June 2022, evaluates these issues, advises, and makes recommendations to the Board of Directors, who make any final resolutions required.

While subject to fluctuations in company performance, this compensation structure is designed to include performance-linked compensation comprising approximately 20% of total compensation under normal circumstances (approximately 25% of which is performance-linked stock compensation).

Fixed compensation and performance-linked compensation for directors were approved at the 98th General Meeting of Shareholders held on June 29, 2022, with the annual limit for compensation set at ¥490 million (¥60 million for outside directors).

The annual compensation limit for corporate auditors was approved at the 84th General Meeting of Shareholders held on June 27, 2008, at ¥72 million, and compensation is awarded within this limit.

At the time these limits were approved, applicable directors and corporate auditors numbered nine (including three outside directors) and four, respectively.

Performance-Linked Compensation

Our directors, excluding our outside directors, are eligible to receive performance-linked compensation.

This is calculated by multiplying a base rate decided according to the director's position by an evaluation coefficient (based on performance evaluation indicators) and a performance coefficient (based on the director's contributions).

Performance-linked compensation is paid out in the following fiscal year.

Until FY2023, we used three performance evaulation indictors specific to our company's performance in the previous fiscal year. These metrics were: percentage of ordinary profit target achieved, ratio of ordinary profit to net sales, and ratio of net profit to net sales.

These metrics enabled us to make a clear evaluation of our business performance.

In FY2021, we achieved 169.4% of our ordinary profit target, our ordinary profit to net sales ratio was 8.7%, and our net profit to net sales ratio was 6.4%. In FY2023, we changed our performance evaluation indicators to the following metrics: percentage of consolidated revenue target achieved, consolidated operating profit margin, consolidated ordinary profit, and percentage of consolidated ROE target achieved.

Executive officers not concurrently serving as directors are also eligible to receive performance-linked compensation under this system.

Performance-Linked Stock Compensation

Our 95th General Meeting of Shareholders held on June 27, 2019 passed a resolution to introduce a Performance-Linked Stock Compensation System (referred to as “the System” below).

The purpose of the System is to clarify the correlation between director compensation and the performance of our group and the value of our company’s stock. It aims to increase directors’ awareness around contributing to the improvement of medium to long-term performance and increasing corporate value by having them share not only the benefits of stock price increases but also the risks of stock price declines with our shareholders.

At its introduction, the System applied to six directors, excluding outside directors.

The System operates by granting points to each director on the day of the General Meeting of Shareholders (the "points granting date"), which we hold every June during the trust period.

These points are based on the director's performance, position, and contributions in the fiscal year ending on March 31 of same year.

Accumulated points correspond to shares allocated to directors upon their retirement.

To align with shareholder perspectives, we use net profit for the fiscal year (consolidated) as our performance indicator.

We do not set a specific target figure for this indicator; compensation is instead a fixed proportion of actual net profit.

Our net profit (consolidated) in FY2021 was ¥5,593 million.

Executive officers not concurrently serving as directors are also eligible to receive performance-linked compensation under this system.

Internal Control System

Structures ensuring compliance with laws and the company's of incorporation in the execution of our directors’ duties, other measures to ensure proper business conduct, and the operating status of these structure

(1) Structure to ensure compliance with laws and the company's of incorporation in the execution of our directors’ and employees’ duties

- Our company has established the SINFONIA-WAY, our corporate philosophy and set of behavioral guidelines.

We have also drafted a Corporate Ethics Code and Corporate Behavior Standards.

We are committed to compliance with laws and our the company's of incorporation and the cultivation of high ethical standards.

We are working on building a compliance system to enhance around this area within the company and prevent issues from occurring. - In accordance with our Compliance Committee Regulations, we appoint officers responsible for company-wide compliance. We have also established an internal organization to advance compliance activities in each department, including a compliance committee comprising representatives from related companies and external experts.

Furthermore, we seek advice from external professionals, such as lawyers, as needed. - As part of the reporting system for violations of laws and the company's of incorporation, we have established a Speak-Up system (internal reporting system).

We specify in our Speak-Up System Operation Regulations that internal whistleblowers must not be treated unfairly.

In the event of an incident, reports are made to top management, the Board of Directors, and the Board of Auditors. - Based on our Internal Audit Regulations, the Audit Department conducts internal audits.

- In our internal controls related to financial reporting, we strive for continuous operation and improvement, based on our basic principles of preparation and operation.

- Our Corporate Ethics Code and Corporate Behavior Standards state that we will sever ties with antisocial forces and establishes basic principles to counter these forces.

(2) System to preserve and manage information related to the execution of directors’ duties

- Our company stores and manages information related to decision-making and execution of duties undertaken by our directors based on internal regulations within the responsible departments. We review these internal regulations as necessary.

(3) Regulations and other systems to manage risk of loss

- In the current rapidly-changing business environment, our company has established Risk Management Regulations, which outline the fundamentals of risk management, and Risk Management Guidelines, which specify our principles for risk management activities.

These measures are aimed at appropriately assessing and addressing risks connected to business operations, legal compliance, safety, health, environment, natural catastrophes, communication of information, and other areas.

We have created a risk management framework by appointing officers responsible for risk management and establishing a risk management committee. - In the event of a crisis affecting the business activities of our company or the entire group, directors and executive officers promptly gather information, report to the representative director, and take necessary measures.

(4) System to ensure efficient execution of directors’ duties

- In order to clarify our management strategies and challenges, we formulate medium-term and annual management plans.

We monitor the degree to which these plans are successfully implemented through a performance management system. -

We hold regular monthly and ad-hoc Board of Director meetings, management meetings, and business execution meetings to swiftly and comprehensively make decisions and provide follow-up on management intentions.

-

We have adopted an executive officer system that separates executive decision-making and supervisory functions from business execution-related functions, allowing us to execute tasks while swiftly and flexibly responding to changes in the business environment.

-

We have established a system under which our executive offers report to our directors on the execution of tasks for which our directors are responsible, allowing the latter to fulfill their supervisory function.

-

We have established approval systems, budget systems, human resources management systems, and other structures to ensure that our directors' duties are efficiently executed with appropriate delegation of authority.

(5) System to ensure appropriate business operations in the corporate group (our company and subsidiaries)

- Based on our Affiliate Management Regulations, our company establishes Supervisory Departments, Business Operation Management Departments, and Business Support Departments.

Additionally, we appoint dedicated staff to the Management Planning Department. -

We deliberate on important issues affecting the entire group carefully through comprehensive discussions at meetings.

-

We assign directors and corporate auditors from our company to attend major subsidiaries' monthly executive meetings and verify the status of their business operations.

-

We promote compliance activities across the company, including in our group companies.

Moreover, we align our compliance approach for our overseas subsidiaries with that followed in Japan, while respecting local laws, cultural customs, and regulations.

(6) Provisions concerning the establishing of roles tasked with assisting corporate auditors when required

- At SINFONIA, our corporate auditors are assisted in their auditing duties by the Audit Department.

- The Audit Department fulfills the role of secretariat to the Board of Auditors and assists in its duties according to the instructions furnished by this Board or by our corporate auditors.

(7) Issues concerning employees assisting corporate auditors in their duties and their independence from directors

- To ensure the independence of employees of the Audit Department from directors or other employees, our company discusses issues related to their appointment, transfer, evaluation, disciplinary action, and other personnel matters with the Board of Auditors in advance of any of the above actions.

(8) Systems for reporting to corporate auditors, including system for use by directors and employees

- Our company’s directors and employees provide access to materials and reports regarding our company and group companies in response to requests from our corporate auditors in line with on our Corporate Auditor Audit Standards.

- Our corporate auditors attend important company meetings, such as Board of Director and business execution meetings, and review important documentation relating to decision-making to audit directors' performance of their duties.

Additionally, the corporate auditors conduct regular interviews with the directors of group companies to understand the overall situation of the group. - In line with our Speak-Up System Operation Regulations, individuals who have reported to corporate auditors or have been involved in such reporting must not be subjected to adverse treatment.

(9) System to ensure effective auditing by corporate auditors

- To ensure the effectiveness of auditing conducted by our corporate auditors, our company takes measures to ensure that the auditing process runs smoothly.

This includes annual Board of Director reviews of the Annual Audit Policy and Plan decided by our Board of Auditors, as well as making it possible to request reimbursement for emergency or extraordinary expenses made in the course of the execution of the corporate auditor’s duties. - We provide opportunities for corporate auditors to exchange opinions with our representative director and accounting auditors.

-

Corporate auditors receives regular reports on internal audits from the Audit Department.